401k required minimum distribution tables

Distribution period from the table Table III for your age on your birthday this. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity.

Required Minimum Ira Distributions Will Resume In 2021 Heintzelman Accounting Services

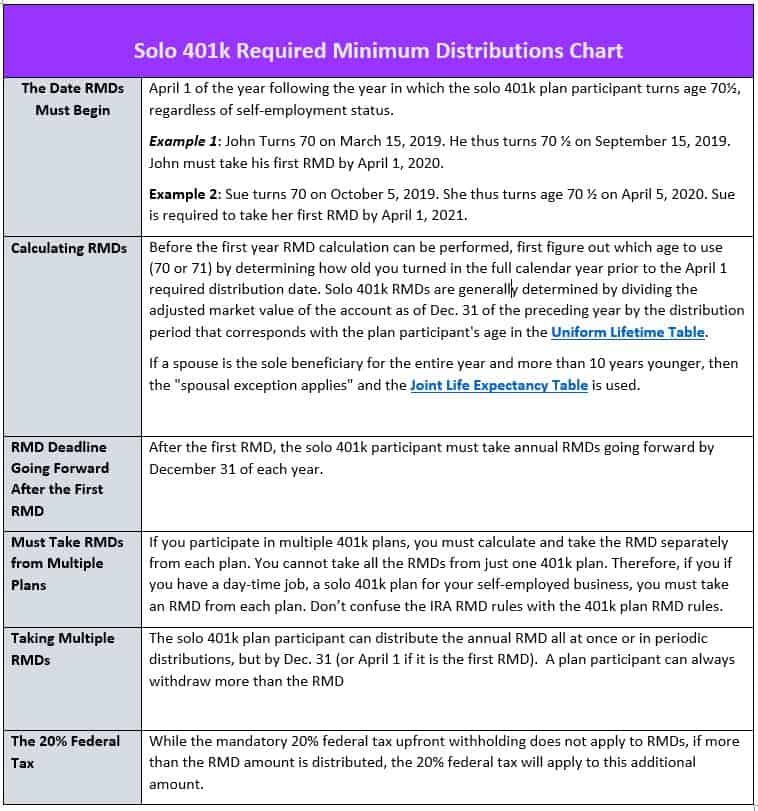

Note that if you delay your first RMD until April youll have to take 2 RMDs your first year.

. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. IRA Required Minimum Distribution RMD Table for 2022. Distribute using Table I.

If you want to download. The required minimum distribution table rmd table for those who reach age 70 and the rmd table for beneficiaries are printed below. Build Your Future With a Firm that has 85 Years of Retirement Experience.

Ad Know Where You Stand and How to Move Toward Your Goals With Informed Confidence. If you turned 72 in June 2022 you have. The age for withdrawing from retirement accounts was increased in 2020 to 72 from 705.

This is your required minimum distribution for this year from this IRA. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year. The second by December 31.

Required Minimum Distributions RMDs generally are minimum amounts that a retirement plan account owner must withdraw annually starting with the year that he or she reaches 72 70 ½ if. Ad If you have a 500000 portfolio download your free copy of this guide now. Use younger of 1 beneficiarys age or 2 owners age at birthday in year of death.

100000 divided by 256 is 390625 which is the amount you must withdraw. To calculate your required minimum distribution simply divide the year-end value of your IRA or retirement account by the distribution period value that matches your age on. Chart of required minimum distribution options for inherited IRAs beneficiaries Publication 590-B Distributions from Individual.

Use IRS Publication 590-B to calculate your 401k RMDs it includes life expectancy tables that correspond to your specific age. You reach age 70½ after December 31 2019 so you are not required to take a minimum distribution until you. Repeat steps 1 through 3 for each of your IRAs.

Ad Learn How Fidelity Can Help You Roll Over Your Old 401k Plan. You are retired and your 70th birthday was July 1 2019. Year you turn age 72 70 ½ if you reached 70 ½ before January 1 2020 - by April 1 of the following year.

TIAA Can Help You Create A Retirement Plan For. These are called required minimum distributions or RMDs and they apply to most tax-deferred accounts. Take the value of your 401k as.

A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year. Prior to 2019 the age at which 401 k participants had to start taking. The first RMD must be taken by April 1 of the year after you turn age 72.

Traditional rollover SIMPLE and SEP. Determine beneficiarys age at year-end following year of owners. After reaching age 72 required minimum distributions RMDs must be taken from these types of tax-deferred retirement accounts.

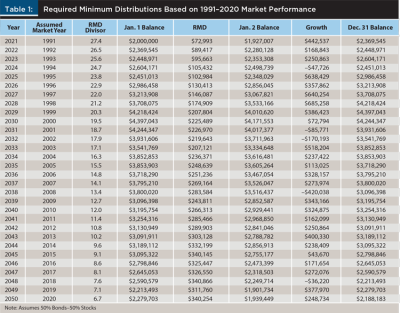

FAQs on Required Minimum Distributions. Get started and take the 3-Minute Confident Retirement check to start finding answers. Uniform Life Table Effective 112022.

The IRS calls that the required beginning date. If you are in the. A factor of 274 at age 72 means that out of a 1 million total balance in the pre-tax retirement accounts as of December 31 of the.

Ad Use This Calculator to Determine Your Required Minimum Distribution. Compare 2022s Best Gold IRAs from Top Providers. Ad Our 3-Minute Confident Retirement check can help you start finding the answers.

Ad Learn How Fidelity Can Help You Roll Over Your Old 401k Plan. Strong Retirement Benefits Help You Attract Retain Talent. Lets say you have a combined 100000 in your tax-deferred retirement accounts.

This 401k distribution calculator is very simple and all it asks is that you enter your account balance at the end of the last year. Reviews Trusted by Over 45000000. Line 1 divided by number entered on line 2.

The first will still have to be taken by April 1.

New Rmd Tables Coming For 2022 Are You Ready Take This Quiz To Find Out

Required Minimum Distribution Rmd By Age Self Directed Retirement Plans

What Is A Required Minimum Distribution Or Rmd Victory Capital

Pin On Ask Your Cfp

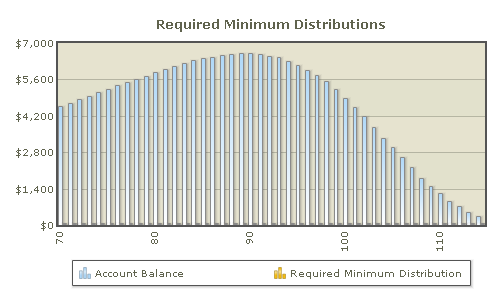

Making The Most Out Of Your Required Minimum Distribution Rmd

Rmd Comparison Chart Iras Vs Defined Contribution Plans How To Plan Profit Shares Chart

Strategies To Reduce Or Delay Rmd Mandatory Withdrawals Required Minimum Distribution Content Strategy Strategies

How Recent Changes To Required Minimum Distribution Rules May Affect Future Value Tsp Accounts

Reduce Your Rmd Tax Tips To Save You Money 2022

Irs Approved Method For Delaying Your Rmd

Required Minimum Distributions As A Retirement Strategy Financial Planning Association

What Do The New Irs Life Expectancy Tables Mean To You Irs Retirement Financial Planning Life Expectancy

Strategies To Reduce Or Delay Rmd Mandatory Withdrawals Required Minimum Distribution Content Strategy Strategies

Solo 401k Rmd Rules Explained Chart My Solo 401k Financial

Rmd Calculator Required Minimum Distributions Calculator

How To Correctly Fix A Forgotten Missed Or Miscalculated Required Minimum Distribution Rmd Ht Required Minimum Distribution Inherited Ira Traditional Ira

New Tables Are Available For Calculating Required Minimum Distributions Rmds In 2022 Julie Jason